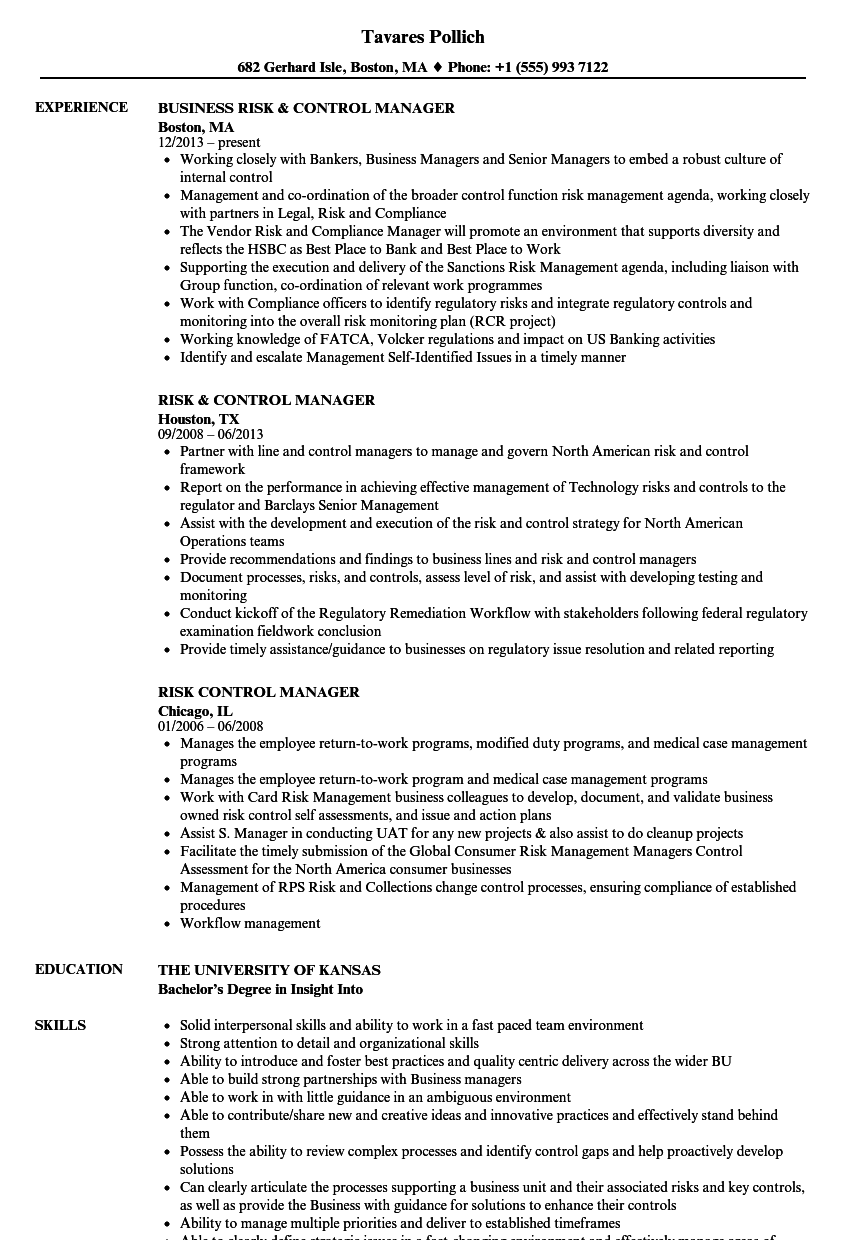

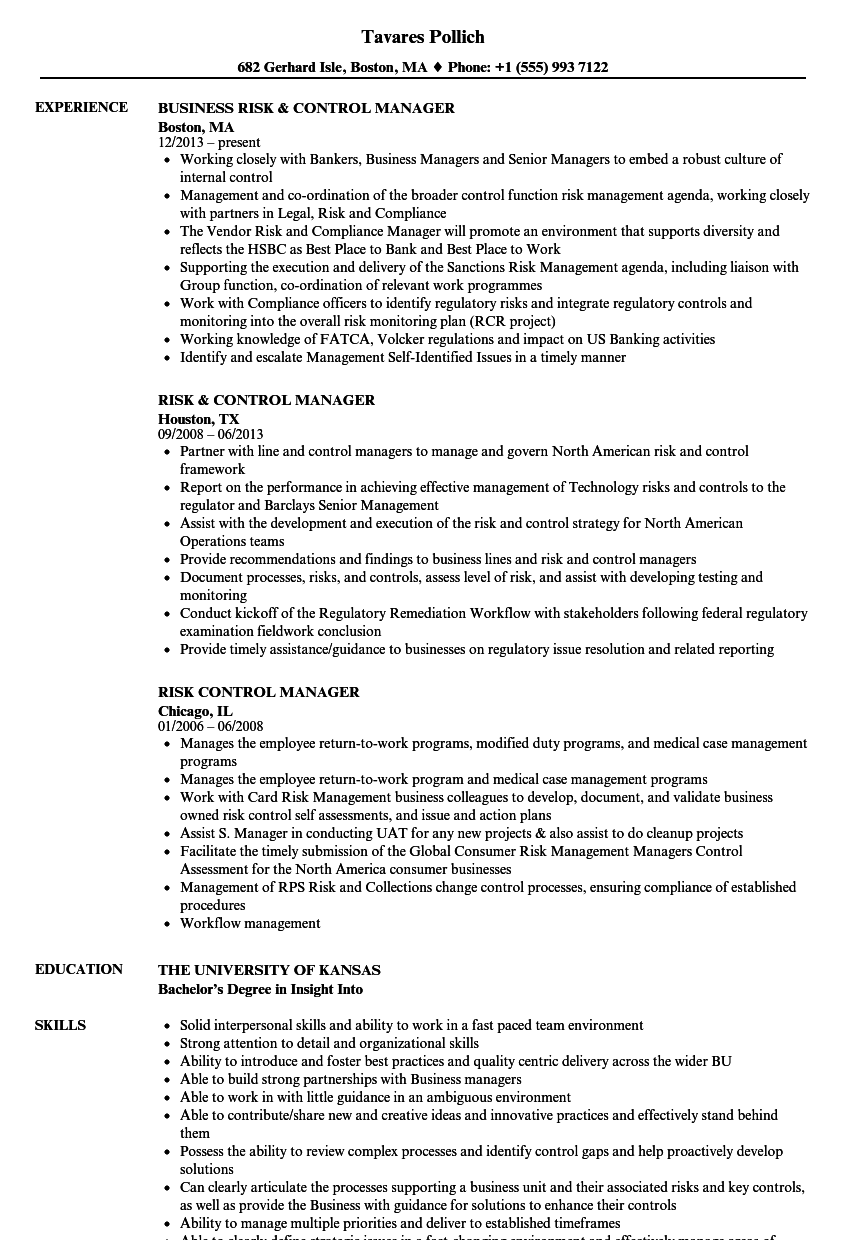

Because this is only intended to show the most important stations briefly, applicants with a lot of work experience can expand the great resume to two pages. After all, it is clearest.Ī great resume usually fits on one A4 page. Because a great resume is presented as a tabular resume, applicants in this format are best able to give a brief insight into their career. The question of the shape is easy to answer. Therefore, as an applicant, you should take advantage of the chance that a great resume offers you. Usually, it is even read before the cover letter, as it gives the HR manager a quick and clear overview of the applicant’s qualifications. For applications in the USA, a great resume is without question.

#Risk manager resume professional

This means that the essential professional career stages are presented briefly and concisely for the HR manager. Strong working knowledge of risk management and previous experience working with risk (i.e.A great resume is usually structured as a tabular resume.You pay strong attention to detail and organization.Ability to handle private, sensitive, confidential information appropriately.Excellent communication skills, both written and spoken.

Computer, data entry and MS Office skills. Thorough understanding of the business or organization's goals and values. Professional Risk Manager (PRM) certification may be beneficial. Provide training and certification for organization staff so that they can be aware of risks and try to avoid them. Make risk-avoiding adjustments to current methods of operation in order to minimize their future risks. Perform risk evaluation, which assesses the way the company previously handled risks. Gather confidential financial information from client such as income, assets and debts. Prepare action plans to decrease risk factors. Identify financial, safety or security risks that the client company or organization may face. You'll be glad you applied to Example Co. If you're excited to be part of a winning team, Example Co. We are hiring a talented Risk Manager professional to join our team. We're proud of our 3.6 rating on Glassdoor from our employees. is one of the leading companies in our field in the area. Risk managers should be able to think outside the box to envision risks that might be otherwise unnoticeable to others.Įxample Co. In-depth knowledge of the company and industry is very important for risk managers, who need to accurately assess risks that may become a reality without intervention by organization management. Graduate degrees look even more impressive on your resum' to potential employers. Most risk managers hold bachelor's degrees in business, management or another related field. Many risk managers begin their careers as risk assistants or risk analysts and move into manager roles once they have enough experience. Risk managers must be able to present their findings to their clients in a way that's easy for the company administration to understand and implement. Risk managers are in charge of research activities such as risk assessment for current company affairs or risk evaluation, which evaluates the company's handling of risks in the past.

Computer, data entry and MS Office skills. Thorough understanding of the business or organization's goals and values. Professional Risk Manager (PRM) certification may be beneficial. Provide training and certification for organization staff so that they can be aware of risks and try to avoid them. Make risk-avoiding adjustments to current methods of operation in order to minimize their future risks. Perform risk evaluation, which assesses the way the company previously handled risks. Gather confidential financial information from client such as income, assets and debts. Prepare action plans to decrease risk factors. Identify financial, safety or security risks that the client company or organization may face. You'll be glad you applied to Example Co. If you're excited to be part of a winning team, Example Co. We are hiring a talented Risk Manager professional to join our team. We're proud of our 3.6 rating on Glassdoor from our employees. is one of the leading companies in our field in the area. Risk managers should be able to think outside the box to envision risks that might be otherwise unnoticeable to others.Įxample Co. In-depth knowledge of the company and industry is very important for risk managers, who need to accurately assess risks that may become a reality without intervention by organization management. Graduate degrees look even more impressive on your resum' to potential employers. Most risk managers hold bachelor's degrees in business, management or another related field. Many risk managers begin their careers as risk assistants or risk analysts and move into manager roles once they have enough experience. Risk managers must be able to present their findings to their clients in a way that's easy for the company administration to understand and implement. Risk managers are in charge of research activities such as risk assessment for current company affairs or risk evaluation, which evaluates the company's handling of risks in the past.

As a risk manager, you are in charge of determining financial, safety and security risks for a company or organization, and you find ways to reduce those risks through planning and problem-solving.

0 kommentar(er)

0 kommentar(er)